No matter what type of investments you are seeking, but mutual funds is the best option and offers convenience to the patrons. With the help of shared fund, you are free to access and gain a lot in the financial market. Mutual funds are the paramount one and provide majorly in several sectors such as stocks, ties and much more. And also, it is the cost-effective way to spread your savings through various asset categories and sectors. At a reasonable cost, you can gain more than what you have expected. Mutual funds are available in two methods such as Direct Mutual Fund and Regular Mutual Fund. Stay hooked with the following article and knows the difference between direct and regular mutual funds!!

What is Direct Mutual Funds?

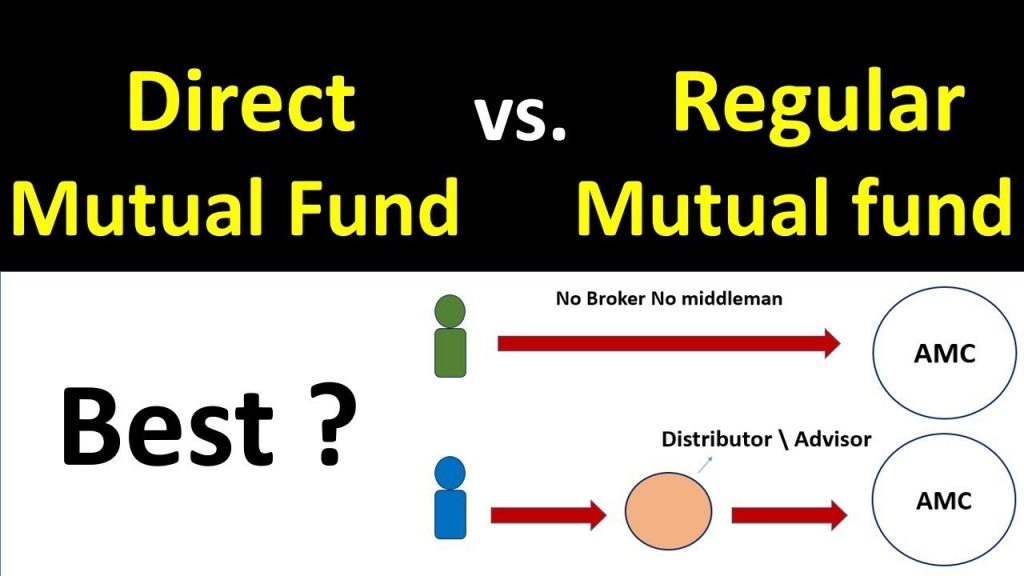

If you are the one who is searching for the investment options devoid of any mediator, then undoubtedly direct plans are a great choice. And also, it is the best one which generates more savings and less expense ratio. And sure, you will reap more benefits and enjoy high returns at the end of the tenure. In this type of funding options, investors can able to perform the research process on their own and achieving different proposals.

In order to be familiar with more about the scheming process, they make use of other niches and blogs. In addition, former plans are the one which is highly suitable for the people who wish to get better and increased returns on their investments. With this, you can take pleasure in any of the things easily and organize the folders on their own in a hassle free way. At the early period, it may look intricate but you should be contented while proceeding with further schemes.

What is Regular Mutual Funds?

If you are ready to invest in the regular funds, then your schemes will be handled by the intermediary and so the outflow ratio of the investment is high. It is because; the bank offers something to the dealer and so the receiver gets little investments. And sure, you will feel a difference nearly more than 4% to 5% when compared to former plans. With a standard track, you will get a chance to reduce instance and efforts and so concentrate on your return results.

What is the variation between the two funds?

Overall, both funds are nearly more or less same but differs at a point something. Comparing the two, direct plan scheme is effective and better since you will enjoy high returns over the long term. Have a look at the following and try to know the real difference between direct and regular mutual funds!

- Outflow ratio is high for regular plan whereas low for direct plan

- Overall return investment of direct plan is high when compared to regular plan

- Market research process is carried out directly by the direct plan whereas regular fund is done by means of agent or broker

- When it comes to convenience, less for direct fund and high for regular plans